does maryland have a child tax credit

CASH Campaign of Maryland 410-234-8008 Baltimore Metro. The credit would be available to all children up to age 5 while maintaining.

The college will send the student IRS Form 1098-T Tuition Payments Statement which will report the tuition and related expenses paid for the student.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979603/GettyImages_1358862218a.jpg)

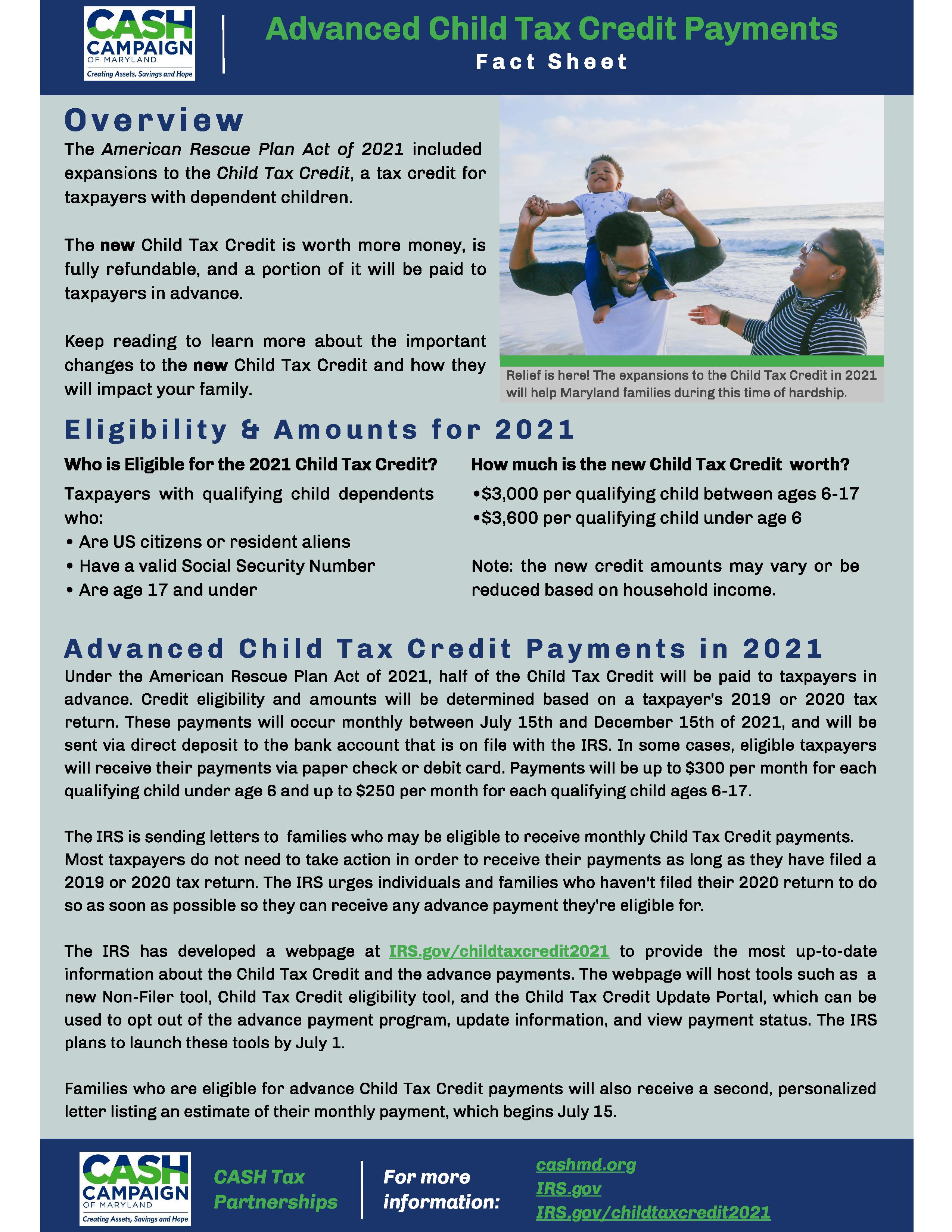

. Its a welcome boost to tens of millions of American families with young children. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. E-File Directly to the IRS.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The Child Tax Credit has been expanded to reach additional children in Maryland many of whom are in families that do not realize theyre eligible for these funds. Ad Home of the Free Federal Tax Return.

Have been a US. Tax Credits and Deductions for Individual Taxpayers. Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159.

Similar to the federal. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit.

If the credit is more than the tax liability the unused. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility. The credit would be available for families with income under 15000 up from the current 6000 limit.

For single filers the credit ranges from 10 to 150. If you have additional questions regarding the Renters Tax Credit please contact the Departments Renters Tax Credit Program at sd atrentersmarylandgov or 410-767. Maryland also restricts eligibility to families with children with disabilities.

The IRS has started distributing payments for the child tax credit. Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data. The credit amount is limited to the lesser of the individuals state tax liability for that year or the maximum allowable credit of 500.

The enhanced Child Tax Credit helped provide Maryland families with a total of 3600 for each child under 6 and 3000 total for each child between ages 6 and 17 per year. Does maryland have a child tax credit Wednesday June 8 2022 Edit. Its easy to claim the credit.

The Homestead Credit limits the. The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not. Through December 2021 thousands of Maryland families recieved monthly payments deposited directly into their bank accounts of up to 300 per child under age 6 and.

AArkansas created a temporary earned income tax credit entitled the Inflationary Relief Income-Tax Credit. All eight states allow filers to claim both the state and federal child tax credit.

Maryland Child Tax Credit Dc News Now Washington Dc

Editorial Texas Children Need Biden To Work With Gop To Extend Child Tax Credit

More Families In Maryland Could Soon Take Advantage Of A Child Care Tax Credit Wamu

Preservation Maryland Maryland State Historic Tax Credit To Support Six New Rehabilitation Projects

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Child Tax Credits The 12 States Are Offering Worth Up To 1 000 In Payments To Parents Marca

Viewpoint Maryland Is Falling Behind In Funding Historic Preservation Tax Incentives Baltimore Business Journal

Tax Credit Available For Families With Children Dhs News

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Maryland May Expand Electric Vehicle Tax Credits Baltimore Sun

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Census Data Shows Need To Make 2021 Child Tax Credit Expansion Permanent Itep

Cash Campaign Of Md On Twitter What Do You Need To Know About The Updated Child Tax Credit Policy Check It Out Here Https T Co Vbqmrlywuw Twitter

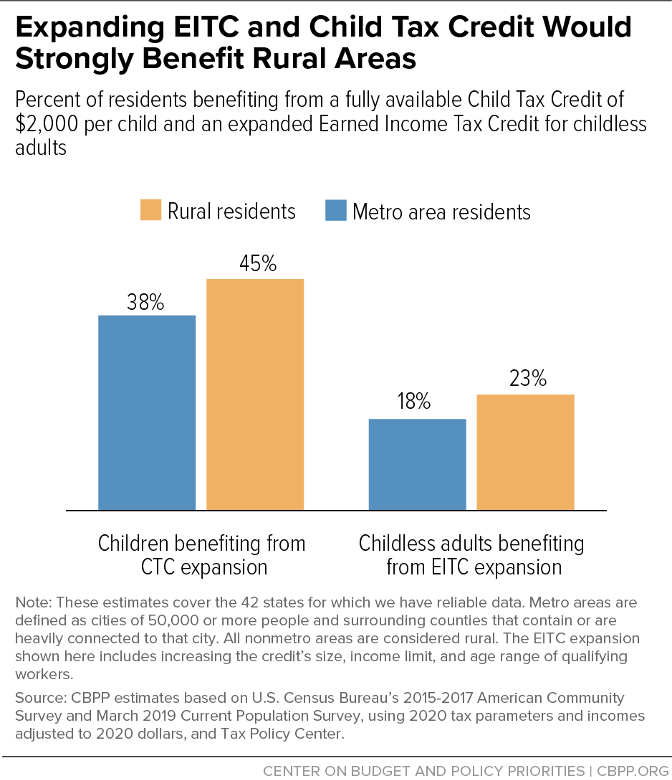

Expanding Child Tax Credit And Earned Income Tax Credit Would Benefit More Than 10 Million Rural Residents Strongly Help Rural Areas Center On Budget And Policy Priorities

Biden S Expansion To The Child Tax Credit Pulling Kids From Poverty Democrats Just Have To Pass It

Among New Maryland Laws Effective Monday Help For Parents Paying Thousands Of Dollars For Child Care Baltimore Sun

In Maryland 79 000 Families Are Eligible For The Child Tax Credit Latest Update Food Contessa